Contents:

This is the appointing of a custodian of a business’s assets during events such as bankruptcy. Internal auditing involves evaluating how a business divides up accounting duties. As well as who is authorized to do what accounting task and what procedures and policies are in place. Public companies have to follow a set of rules set out by the government (this is the Securities and Exchange Commission in the U.S.). Some of these branches of accounting are important to small businesses.

- Introductory level accounting courses are difficult to some students and are easy to others.

- It is more detailed than the information given to the external users of the company.

- Financial accounting involves the preparation of accurate financial statements.

- This is where management use accounting information to make critical and informed decisions.

- Just give us a few brief details about your business, and we’ll match you up with trusted companies, who’ll be in touch with tailored, no-obligation quotes and information.

- List and describe four of the five concepts’ impact on the accounting process.

Recommended college coursework includes general accounting, computerized accounting, cost accounting, taxation, business statistics, and financial management. It is important to remember that a CPA is required to pass a licensing exam in addition to finishing their college coursework. According to PayScale.com, the average salary of a CPA is $65,397.

Payable accounts

Forensic is one of the types of accounting that comes into work to investigate any company’s financial information to collect potential evidence of any crimes. Cost accounting is employed to find the net cost generated by a company after assessing all its assets and liabilities. Tax accounting helps to prepare and manage the tax returns and payments of businesses. Tax accountants work with these entities to ensure accuracy when calculating and reporting tax liabilities for their clients. The main difference between financial accounting and governmental accounting is that governmental entities use separate funds to keep track of income and expenditures. Accountants can also investigate white collar crimes, audit businesses, or work exclusively in government and manufacturing environments.

Some of their duties may include preparing taxes, monthly/quarterly reports, and financial statements. They can create and evaluate others’ budgets, handle bookkeeping, accounts payable, and accounts receivable, among other duties. Financial accounting is the set of rules used to compile a company’s financial statements.

Taxation, risk management, supply chain management, cost management, managerial accounting, and auditing are courses useful to future financial consultants. According to PayScale.com, the average salary of a financial consultant is $67,099. Although certified public accountants are best known for their work on both federal and state taxes, they manage much more than that. In many industries, a CPA may be hired to manage the organization’s staff accountants. Because a CPA has an extensive, focused education that required the passage of specialized exams, they’re often treated as an organization’s financial advisor.

Generally, staff accountants also work to ensure that the organization is compliant with financial regulations that affect their particular industry. As a staff accountant gets more experience in an industry, they may also be called on to create financial forecasts. The main goal of accounting is to record and report a company’s financial transactions, financial performance, and cash flows. Multiple types of accounting careers exist within the financial industry, with each performing a differing range of functions.

Why outsource your accounting?

statement of activities accounting records, analyzes and reports all of a company’s costs related to the production of a product. This field requires excellent knowledge of the relevant accounting framework, as well as an inquiring personality that can delve into client systems as needed. The career track here is to progress through various audit staff positions to become an audit partner.

Different from the other types of accounting, tax accounting considers deductions, revenue, and government credits to determine the company’s taxable income. Taxable income never stays the same; it changes yearly and mainly depends on the company’s revenue. Accounting is a process that helps businesses gather, analyze, and report financial and non-financial data. There are various types of accounting that serve specific purposes in various economic fields. Additionally, tax accounting is used to accurately calculate tax due, lower tax liability, complete tax returns accurately, and file tax forms in a timely manner. This is necessary for individuals, businesses, government entities, and nonprofits.

- This helps them to establish a budget for future projects of a similar nature.

- Even if the client hasn’t paid yet, revenue is still recorded in the books.

- Classifying financial transactions by account, according to the firm’s Chart of Accounts.

External auditing is the process through which an external, independent certified public accountant reviews the company’s accounting records and prepares a detailed report of the findings. Auditors may be called on to verify a business’s compliance with internal or regulatory standards, investigate suspicious financial activity, analyze the accuracy of financial statements or review tax returns. Public accounting firms provide accounting services to a variety of clients, including service businesses, manufacturers, retailers, nonprofit organizations, governmental organizations, and individuals. Public accounting focuses on auditing, tax preparation, tax advisory, and consulting activity, including financial statement preparation and analysis. Those in the financial accounting field are concerned with the aggregation of financial information into external reports.

Money makes the world go round, so you’d better ensure your business is equipped to receive payments! Whether you’re selling products online or taking payments in a brick and mortar store, ecommerce platform builders, merchant accounts, and POS systems will help you rake in the cash. Therefore, it can be said that any transaction that is entered into by two persons or two organizations with one buying and the other one selling is considered an external transaction. Creditors are the primary external users of accounting information.

Balance Sheet

How much you outsource depends on your existing team’s expertise, time, and budget. Using a forensic accountant is one of the best ways to deal with a possible financial crime, as they’re well-trained in investigating these types of crimes, and have the necessary knowledge and expertise. Paying the right amount of tax is crucial to staying compliant, and getting this wrong can mean having to pay a penalty. Outsourcing your tax accounting doesn’t just mean you can be certain your taxes are above board, but you also have access to expert advice. Small to medium-sized businesses tend to outsource this service, whereas larger enterprises usually keep this in-house, as they have the budget and resource to hire for this role.

How to Open a Bank Account in Indonesia? – ASEAN Briefing

How to Open a Bank Account in Indonesia?.

Posted: Fri, 21 Apr 2023 11:05:02 GMT [source]

These documents are used to develop budgets, identify opportunities for cutting costs and monitor the overall financial situation of the company. That’s why it makes sense to hire a good financial accountant to track, record and report financial transactions and create financial statements for your company. Tax accountants help individuals, businesses and nonprofit organizations comply with the Internal Revenue Code. They also help their clients develop tax strategies to reduce their taxes as much as legally possible. Accounting concepts are the assumptions based on past records that facilitate the business entities to follow laws and rules in maintaining the accounting records.

Marginal cost accounting

Also, the audit confirmed that the internal controls are effective. Auditing primarily aims to ensure that all the financial records of our company statements are accurate and have followed the regulatory guidelines. They analyze the financial accounts and records that can be used as legal; evidence in court if required. In simple words, it is a type of accounting that is suitable only for legal proceedings. Forensic accountants use their auditing, accounting, and investigating skills to understand if any individual or company has committed financial misconduct, like fraud.

It is governed by the Internal Revenue Code, which must be strictly followed when individuals and companies prepare their tax returns. Using the cash accounting method, a company bookkeeper debits and credits the cash account in each journal entry. Transactions with no monetary input are not included in the financial statements. With this method, bookkeepers debit and credit the cash account in each journal entry depending on the transaction.

These firms perform audits of companies, organizations, small businesses, government entities, and individuals as well. This article covers how outsourcing accounting services will help save time and money. A Certified Internal Auditor demonstrates creditability into maintaining the control environment within a company by overseeing processes and procedures related to financial accounting. The Certified Management Accountant designation is more demonstrative of an ability to perform internal management functions than financial accounting. Vendors or suppliers may ask for financial statements as part of their credit application process. Suppliers may require credit history or evidence of profitability before issuing credit or increasing credit to a requested amount.

The two main types of financial accounting are cash accounting and accrual accounting. Internal auditing is when the company’s finances are audited by accountants who work for that company. It’s typically done by tax, financial or managerial accountants, depending on the audit’s purpose. As with tax accounting, financial accounting mistakes can cost you a lot of money and get you in legal trouble. These firms monitor and audit their own company or business to ensure a systematic set of checks and balances to ensure that all money is accounted for always. Full-service accounting firms are large enough and are allowed enough resources to cover every single type of accounting service out there.

Public accounting refers to businesses that provide accounting services. This type of accounting is generally the most comprehensive, with public accounting businesses tending to specialise in various accounting areas. With a bookkeeping service, your business’s financial transactions are recorded and tracked. Bookkeepers turn these into financial reports, so you can accurately and easily monitor your business’s finances.

Financial Accounting Advisory Services Market 2023 Growth, Trend … – Digital Journal

Financial Accounting Advisory Services Market 2023 Growth, Trend ….

Posted: Wed, 19 Apr 2023 09:19:30 GMT [source]

Some of these professionals are referred to as forensic accountants. Auditors analyze companies’ financial statements for accuracy and compliance with state and federal regulations. They review the business assets, bank balances, expenses, income, and ledgers. This accounting service is aimed at analysing the company’s financial statements, which the managers use in making crucial decisions.

Resources for YourGrowing Business

Typically, there is a core set of accounting classes that students take. Most of them are described below, but keep in mind that this list is not all-inclusive. Class titles may vary from school to school and the composition of classes may be somewhat different, but overall topics covered are usually similar. The Certified Information Systems Auditor exam tests proficiency on maintaining the systems of an entity and may directly or indirectly influence the outcome of the financial accounting process. Financial accounting may be performed under the accrual method or under the cash method .

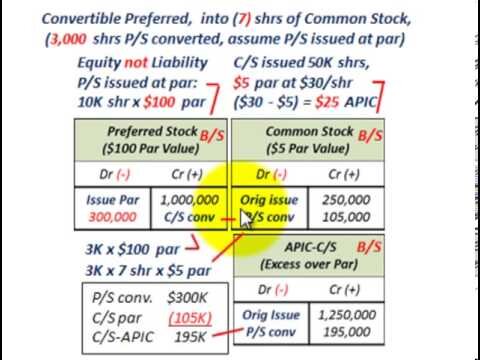

Forensic accounting is used to investigate the financial activities of both individuals and businesses. It is frequently used by banks, police departments, attorneys, and businesses, examining financial transactions and later providing those findings in a completed report. Cost accounting is considered a form of management accounting, focusing on the future, and is primarily used as an aid in the decision-making process rather than as a way of reporting past performance. Management reports focus internally while financial statements focus on company performance. While very small businesses frequently use cash accounting, all larger businesses as well as publicly traded businesses are required to use accrual accounting.

Each branch has its own specialized use that reveals different insights into a business’s financial status. But it does follow standard accounting practices taught in accounting school. Based on the basis, the company can take corrective actions in a far better way. Fixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business activity.

Whether governed by GAAP, GASP, or IRC rules and regulations, the one thing that all types of accounting have in common is their adherence to facts. All financial auditors are accountants, though all accountants are not auditors. Tax accounting requires accountants to be familiar with the various tax laws that change from year to year. Most businesses will use a standard costing system, which assigns an average cost to product production, though other costing methods can be used.

The management team needs accounting in making important decisions. Business decisions may range from deciding to pursue geographical expansion to improving operational efficiency. Accounting can be classified into two categories – financial accounting and managerial accounting.

Forensic AccountingForensic accounting is the investigation of fraud and misrepresentation. Moreover, the US government’s net position and total liabilities decreased in the year 2021 from $5,955 to $4,893. It is a beneficial procedure for identifying how much the company is earning, where the money is being seen, and where it is being lost.

Tax Fraud Blotter: The naughty list – Accounting Today

Tax Fraud Blotter: The naughty list.

Posted: Thu, 20 Apr 2023 19:16:00 GMT [source]

Still, the goal is for everything to be accurate and prepared in an ethical manner. Managerial accountants, also known as management accountants, collect financial data, analyze it, compile it into reports and then present it to the company’s management. Unlike the previously mentioned financial statements, these reports are intended for internal use only and aren’t governed by external regulations.